U.S. stocks edged lower Friday after hitting record highs in the previous session, as investors weighed fresh economic data and looked ahead to an expected Federal Reserve interest rate cut next week. Despite the pullback, major indexes remain on course to finish the week higher.

Stocks Pull Back From Records

The Nasdaq Composite briefly touched an intraday record before paring gains, while the S&P 500 and Dow Jones Industrial Average slipped into negative territory during morning trading.

At 10:06 a.m. ET, the Dow was down 77 points, or 0.17%, at 46,030.94. The S&P 500 inched up 1.10 points, or 0.02%, to 6,588.57, while the Nasdaq rose 44.57 points, or 0.20%, to 22,087.64.

Losses in communication services names, including Alphabet and Meta Platforms, offset strength in heavyweight tech stocks. Energy shares advanced, lifted by a nearly 2% jump in oil prices, while industrial and consumer discretionary stocks dragged on the Dow.

Fed Rate Cut Expectations Rise

Markets are pricing in a 25-basis-point rate cut when the Federal Reserve meets next week, with odds of a larger 50-point move rising to 7.5%, according to CME’s FedWatch tool.

A string of reports has signaled a weaker labor market than previously thought, while Thursday’s inflation reading reinforced expectations that the central bank will deliver at least three quarter-point cuts by year’s end.

Read More: US Warns of Hidden Radios in Foreign-Made Inverters and Batteries

“We’re likely going to see 75 basis points one way or the other this year and likely another 50–75 basis points over the next 12 months,” said Art Hogan, chief market strategist at B. Riley Wealth.

Meanwhile, the University of Michigan’s preliminary September consumer sentiment index came in at 55.4, below the 58 economists had forecast.

Weekly Gains Driven by AI Rally

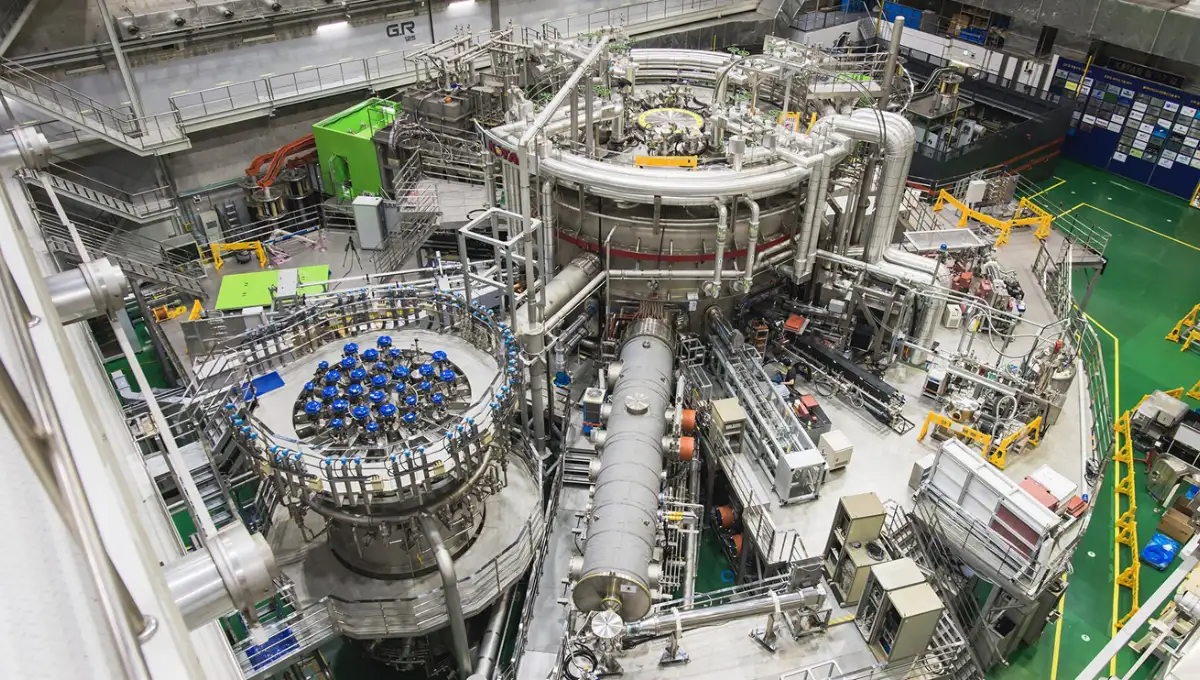

Despite Friday’s subdued trading, all three indexes are on track to notch weekly gains. A rebound in artificial intelligence-linked stocks fueled much of the momentum earlier in the week, following Oracle’s upbeat cloud forecast.

That optimism spilled over into AI chipmakers and utilities powering data centers, helping the S&P 500’s technology sector outperform peers.

Movers in Focus

- Warner Bros Discovery surged 8.9%, extending a 28% rally from earlier this week, amid reports Paramount-Skydance may bid for the studio.

- Microsoft gained 1.2% after striking a non-binding deal with OpenAI to restructure the AI startup into a for-profit company.

- Super Micro Computer climbed 3.7% as it began volume shipments of Nvidia’s Blackwell Ultra AI systems.

The S&P 500 recorded 16 new 52-week highs and two new lows, while the Nasdaq posted 58 new highs and 11 new lows.

September Defies History—So Far

The positive start to September stands out for a month that has historically been difficult for U.S. equities. Since 2000, the S&P 500 has averaged a 1.5% loss in September, according to data from LSEG.